I still remember the feeling of the heavy coins I had been given by my mother and demonstratively dropped into the collection bowl on the altar. The violent clang—metal against metal—if the men in front of me hadn't already filled the bowl with twenties and fifties, or even an occasional hundred kroner bill.

One by one we paraded, goose-stepping, while we and the rest of the congregation kept a sharp eye on each other. Everyone knew who ranked highest in the hierarchy. Just the thought of a wallet in that league! The fishermen had struck a vein of gold in the early eighties.

Towards my teenage years, it slowly dawned on me that what we humans hide from is not the gaze from above, but rather each other. (No wonder the world doesn't always feel like paradise).

As a boy, I went to church almost every Sunday.

I never felt like part of the community, but more like a kind of an observer. Without quite being able to understand either the excessive devotion or the judgmental eyes I just listened and wondered.

Towards my teenage years, it slowly dawned on me that what we humans hide from is not the gaze from above, but rather each other. (No wonder the world doesn't always feel like paradise).

Even then, I had a very, very hard time making ends meet in the performance: Why couldn't we just—in all discretion—put our contribution in the church box on our way out?

It was a long time before I learned that there was such a thing as social control.

Although I also enjoyed being on the same page as the adults, I could easily see that there was something completely unchristian about the way people measured each other up and equated the amount of money with the degree of faith. Both contrary to the Lutheran message I heard my father formulate from the pulpit Sunday after Sunday.

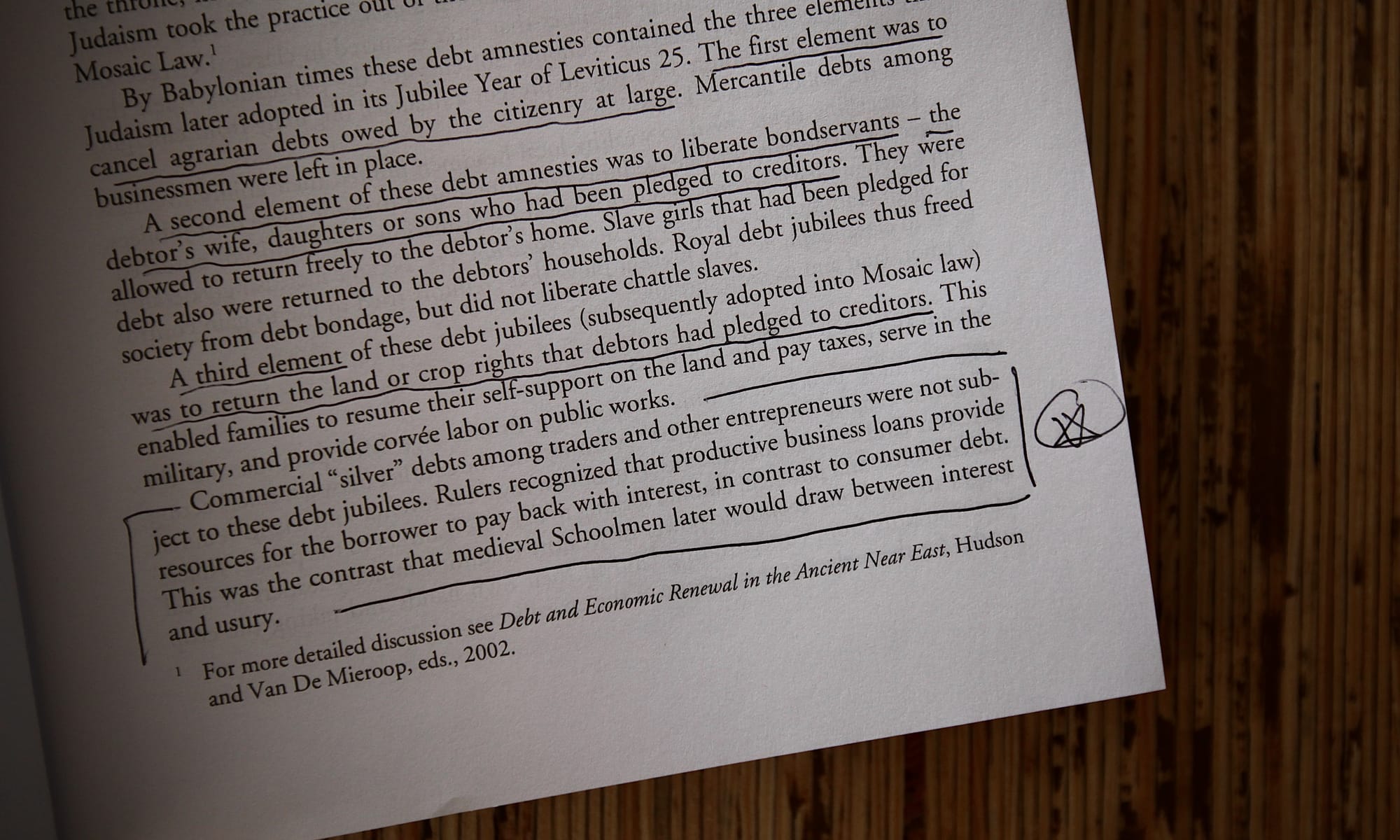

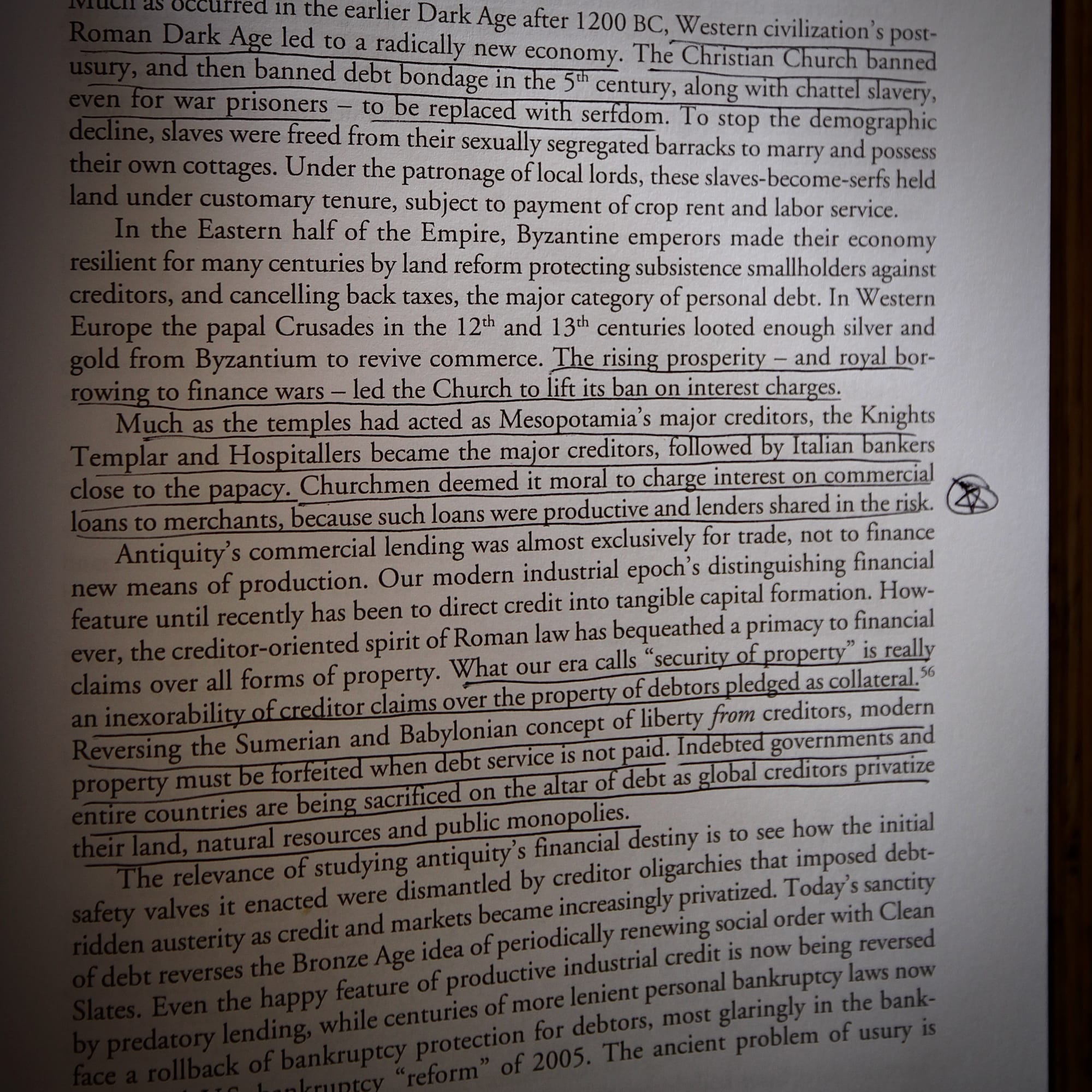

The American economist and historian Michael Hudson has a point when he claims that the debt Jesus teaches his disciples to ask others to forgive is of a very tangible, economic nature. Jesus rebelled against the money-changers and the pawnbrokers, whom he very symbolically threw out of the temple. As Christians, we should excel in jubilees, forgiveness and amnesty—not interest imputation or financial speculation.

A few of my many underlinings after my first read through Hudson's book.

The one and true narrative

I cannot shake the thought that there is something symbiotic between the convinced missionaries and the pugs in the financial world, and not least the way the two groups view the world and the rest of us: We fundamentally do not accept that doubts are raised about our worldview, and woe to the poor heathen who does not voluntarily throw himself in the dirt and praise this, our one and true narrative!

Most of us have bought into the story of the lazy southern Europeans who, both collectively and individually, should have shown a whole lot more moderation. However, the story of the fall of Greece is also the story of a Northern European banking sector that made quite huge and far too expensive loans, knowing that it would never be realistic for the Greeks to settle the debt.

Part of the borrowed money actually financed the Greeks' net import of consumer goods from Northern Europe and was thus ultimately channeled back into the pockets of the industrial magnates and investors who own the banks that granted the loans.

Somewhat the same story with Italy—except that the country is simply too big and powerful an economy to lie down and let other, upright outsiders dictate fiscal policy to the last decimal.

Economically, cutting public budgets is not necessarily the best cure either, as the development of the Portuguese economy since the financial crisis confirms.

The less money the government pumps into the economy in the form of wages and investments in necessary infrastructure, the more general activity in the private sector is slowed down and the more difficult it will also be to pay off the already far too high debt.

If economic activity falls (further), the company's profits fall as well as wages, and thus the tax base. If the goal is to reduce the debt burden, the productive part of the economy must necessarily be kick-started. With deflation looming, tight fiscal reins often have the exact opposite effect.

Rather than a socio-economic rescue plan, the cuts in the public budgets also look like a kind of punitive action, based on what we can with some right call household economic logics. Pure religion, where the stern faces in the circle around the IMF and the ECB have chosen to confess to the prophets Friedman and Hayek.

In the case of both the Greeks and the Italians, morality was in focus, and the message was clear that living beyond one's means and using other people's money had to end. The belt had to be tightened, and expenses adjusted to income. (In fact, the exact same message I was given by Ringkjøbing Bank as a young student).

Unlike one household—where it can be both timely and sensible to spend less money than you earn—however, it is catastrophic for an entire society when all households over a wide range stop spending money.

It went over my head for many, many years—and I think few people actually give it a thought—but the whole prerequisite for showing moderation and saving is that others get into debt and spend beyond their means.

No Germans without Greeks and Italians

Nice enough to pay off the debt, which for many people rhymes with moderation and timely care. But paying off the debt is also reducing the banks' assets and thus the total amount of money available in the economy at any given time.

If no one wants to borrow money, the social economy simply comes to a standstill. The money that is accumulated as savings is also necessarily created out of a debt relationship.

Debit and credit—

It's actually not that difficult at all.

For the record, let me repeat that borrowing as we know it today does not include (other people's) savings. Borrowing, on the other hand, is a prerequisite for there to be money in circulation at all, which someone can put aside.

Hearing Brussels and Frankfurt impose a ruinous austerity fiscal policy on the Italians and Greeks has a lot in common with the way a revival preacher tells his congregation that everyone is a sinner by God's grace. The logic and the common sense, with which one unscrupulously inflicts a lot of suffering on other people is nauseating.

It is worth noting that the relationship between debtor and creditor is only of an economic and not of a moral nature. Those who save net are no better people than those who spend net; rather the contrary.

For the record, let me repeat that borrowing as we know it today does not include (other people's) savings. Borrowing, on the other hand, is a prerequisite for there to be money in circulation at all, which someone can put aside.

Bank money is a debt relationship and, not least, trust that the debt will be repaid over time, which society and taxpayers ultimately guarantee.

This also means that no society moves if good projects and welfare cannot be financed, and the money that has already been created is parked in real estate and financial assets. If we are talking about tarnish, bad morals, the bottle does not point to hopeful borrowers, but rather unequivocally to lax, careless and, in particular, far too expensive lending.

Those who pay the interest are the last in the world to be ashamed—and a loan agreement is, by the way, only a matter between lender and borrower. The money you borrow from the bank is no one else's, or even money that is already in the basement, or is in an account and must earn interest. You do not borrow other people's things or property and therefore have no reason to feel inferior to other, more wealthy customers.

On the contrary, in fact. The money you borrow is created for the purpose—and where a net depositor is a decidedly bad business, lending is the financial sector's golden calf. The banks are only really in trouble the day no more useful idiots dare, or are able to take a chance. It is not risk-taking capital, but risk-taking customers the banks need. We've just always been used to thinking it the other way around.

So—

From now on, stop buying the premise that patrons are sinful souls who should learn to curb their lusts. It's still idiotic to buy imported kitchens and windows, big diesel cars, flights, and fashion clothes sewn far too far in violence. No doubt about it. But it is neither worse nor better to do it with borrowed money than one's so-called own.

The real sin is that it is still to this day largely free to exploit and destroy our common resources and the planet; that it is close to impossible to finance small entrepreneurial projects and quirky ideas at prices ordinary people can pay; not least that absurd phenomena such as factory farms, patented semen, plant protection and robber dens such as Wall Street, London City and Dubai exist at all.