Anders Christian Dam recently stole the headlines in Denmark with his proposal to ban cash by law and not least his claim; that the increasing demand for notes and coins is primarily driven by a growth in the black economy and widespread cheating with tax and social benefits.

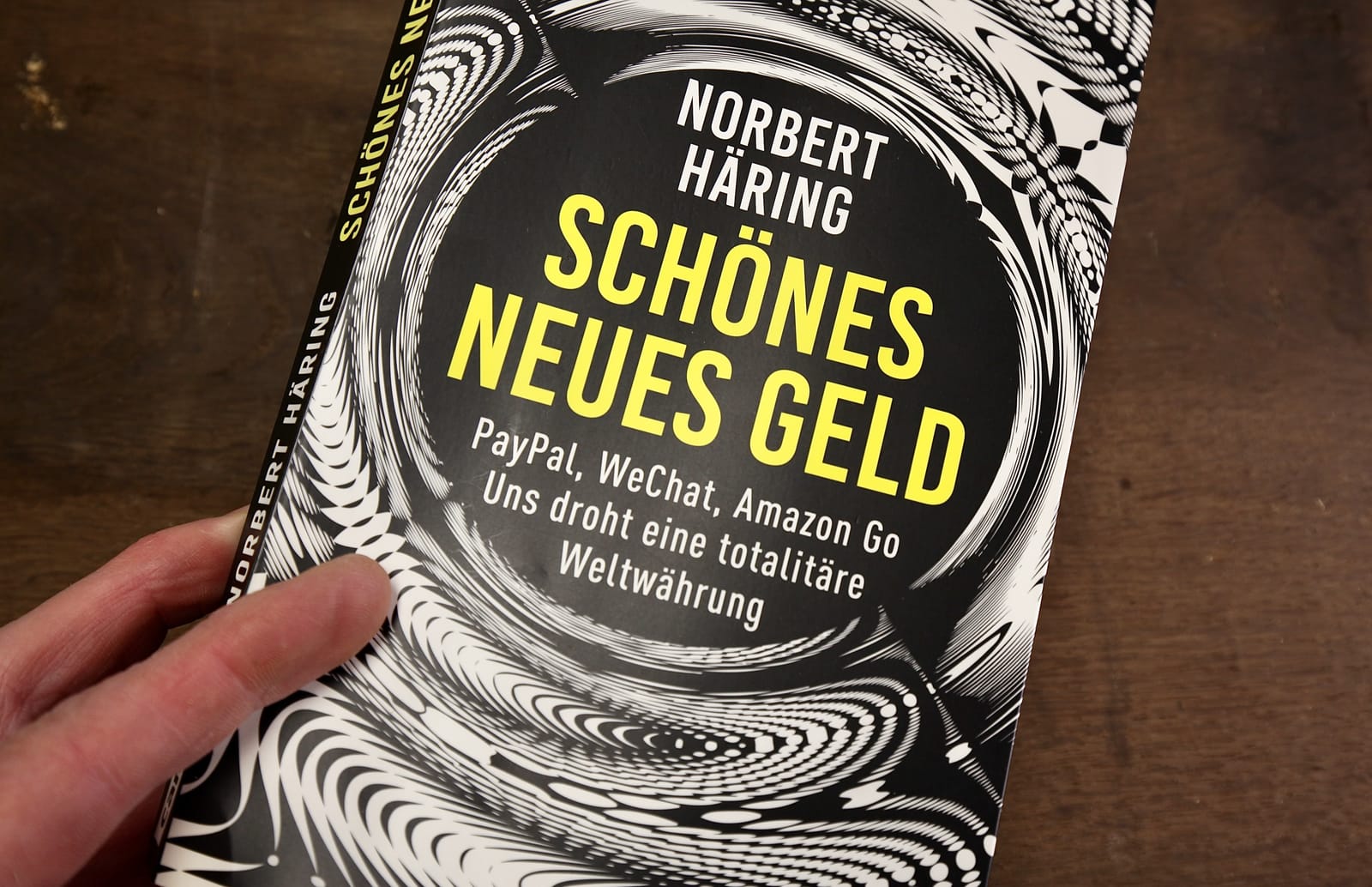

You don't have to read many sentences in Norbert Häring's book Schönes neues Geld (Brave new money) before it strikes you how the Jyske Bank director joins the ranks of prominent financiers who in recent years have spoken warmly in favor of abolishing cash money.

The book title's reference to Aldous Huxley's Brave new world (in German Schöne neue Welt) is thus anything but accidental.

With usual thoroughness, the German science journalist uncovers how, among others, Melinda and Bill Gates' billion-dollar fund, Citibank, MasterCard and VISA, under the auspices of the unholy Better-than-cash alliance, work to force the cash out, globally.

With Orwellian newspeak, and ice-cold lobbying in the government corridors, the alliance has succeeded in implementing everything from amount limits on cash payments and phasing out the largest Euro notes, to absurd money laundering rules that make the banks' already complicated work with handling cash even more complicated .

The advantages for the multinational groups and the financial sector are of course clear: the costs of cash handling are disproportionately large and unlike coins and notes, electronic money moves across the globe in a split second.

Correspondingly, it surely appeals to governments and authorities that the control and sanctioning possibilities increase proportionally with the proportion of electronic payments.

In that context, there is something libertine, rebellious about the use of old-fashioned coins and banknotes.

In addition to his writing, Norbert Häring has made a name for himself by publicly refusing German television to withdraw the statutory license from his bank account, but insisting on paying it in cash. Despite the fact that banking legislation in Germany gives Euro notes unlimited priority as a means of payment, there is no option to pay in cash today. The entertaining, and still ongoing, legal process is extensively documented at norberthaering.de.

The fact that electronic transactions and payments can be traced, and thus—at least in principle—makes terrorist financing and financial crime impossible, is one of the Better-than-cash alliance's main arguments for moving away from the old-fashioned cash.

However, the moment you log every consumer behavior, and on top of that build giant banks with the population's biometric data (as has happened in India, Pakistan, and several places in Africa) the total surveillance nightmare is not far away.

Based on Jeremy Bentham's panopticon, in the fourth part of the book, Norbert Häring reviews the striking similarities between the social point system in China and the potential of the self-learning systems behind digital platforms and markets such as Facebook and Amazon.

When we as citizens know that our behavior is recorded and pattern recognized, it in itself has an educational effect and can have direct consequences for our choices, and for example the prices we have to pay for a given service. The book title's reference to Aldous Huxley's Brave new world (in German Schöne neue Welt) is thus anything but accidental.

As you work your way through Schönes neues Geld, you're overwhelmed by the many examples of Gates- and USAID-sponsored global governance. Unfortunately, that way it also becomes a bit one-dimensional. It would not have harmed the project if Norbert Häring had written in a slightly less embittered tone and maybe hands-on had told us why the cold cash is in fact our best (and only) hope for the future.

Nevertheless, the book is a must-read.

Speaking of hands-on. If after reading Schönes neues Geld, you are completely knocked out by the thought of big brothers coming, you can always take comfort in one of Anders Christian Dam's arguments for banning cash: If we eliminate coins and notes, it will of course, as he writes, minimize the risk of infection and disease spread.

On the other hand. If all of us mere mortals were as good at washing our hands as the bank managers, transmitted bacteria and viruses would probably not be an issue at all.

Norbert Häring: Schönes neues Geld

Bound: 256 sider

Campus Verlag (2018)